IMARC Group, a leading market research company, has recently releases report titled “Ready to Drink Tea and Coffee Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033,” The study provides a detailed analysis of the industry, including the global ready to drink tea and coffee market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the ready to drink tea and coffee market?

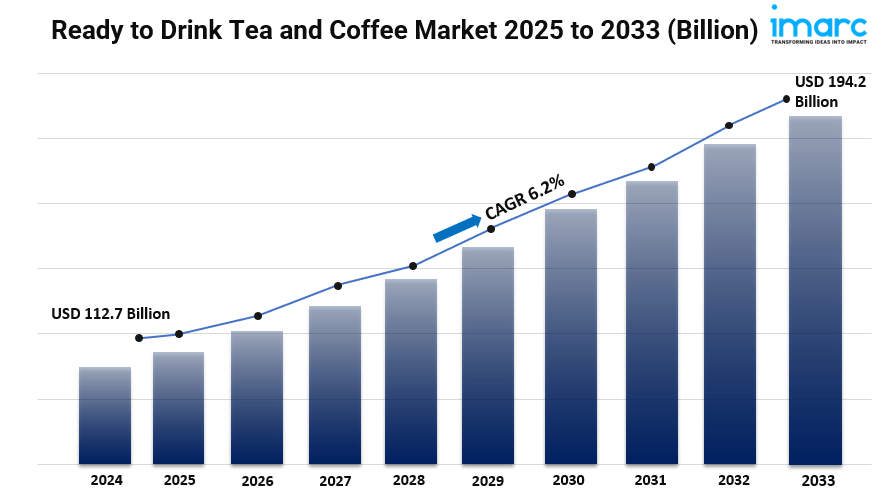

The global ready to drink tea and coffee market size reached USD 112.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 194.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033.

Factors Affecting the Growth of the Ready to Drink Tea and Coffee Industry:

Health and Wellness Trends:

The ready-to-drink tea and coffee market is shifting towards health and wellness. More people are choosing drinks with health benefits. This includes products with natural ingredients like adaptogens, superfoods, and vitamins. Brands are responding by creating drinks that also improve health. These benefits include better immunity, clearer thinking, and easier digestion. Cold brews and herbal teas are becoming popular. They are seen as healthier than sugary drinks. As people learn more about their diets, the ready-to-drink market will likely grow. Brands will keep innovating to meet these health-focused demands.

Sustainability and Ethical Sourcing:

Sustainability is now key in buying decisions for ready-to-drink tea and coffee. In 2024, eco-conscious consumers seek products that match their values on the environment and sourcing. Brands with recyclable packaging, fair-trade ingredients, and low carbon footprints stand out. This appeal not only attracts environmentally aware consumers but also builds loyalty among millennials and Gen Z. They prioritize sustainability. So, companies are now investing in sustainable supply chains and clear labeling. This shows their commitment to environmental responsibility. Thus, demand grows for ready-to-drink beverages that are both tasty and ethically made.

Convenience and On-the-Go Consumption:

Modern consumers’ busy lives are boosting the ready-to-drink tea and coffee market. They seek convenient drinks for their routines. This trend will grow in 2024. People will look for quick, portable drinks for work, commutes, or outdoor activities. Brands are responding by expanding their offerings. They now provide more flavors and formats, like cans, bottles, and pouches, for on-the-go drinking. The rise of e-commerce and delivery services is making these drinks easier to access. This further fuels market growth. Convenience is crucial in consumer choices. Brands focusing on easy access and portability will succeed.

Request for a sample copy of this report: https://www.imarcgroup.com/ready-to-drink-tea-coffee-market/requestsample

Ready to Drink Tea and Coffee Report Segmentation:

Breakup by Product:

- RTD Tea

- Black Tea

- Fruit & Herbal Based Tea

- Oolong Tea

- Green Tea

- RTD Coffee

- Ginseng

- Vitamin B

- Taurine

- Guarana

- Yerba Mate

- Acai Berry

RTD tea account for the majority of shares because its health benefits and wide variety of flavors appeal to a broad consumer base seeking alternatives to sugary drinks.

Breakup by Additives:

- Flavors

- Artificial Sweeteners

- Acidulants

- Nutraceuticals

- Preservatives

- Others

Based on additives, the market has been divided into flavors, artificial sweeteners, acidulants, nutraceuticals, preservatives, and others.

Breakup by Packaging:

- Glass Bottle

- Canned

- PET Bottle

- Aseptic

- Others

PET bottle represents the majority of shares due to its lightweight, durability, and recyclability, making it ideal for on-the-go consumption and mass distribution.

Breakup by Price Segment:

- Premium

- Regular

- Popular Priced

- Fountain

- Super Premium

On the basis of price segment, the market has been classified into premium, regular, popular priced, fountain, and super premium.

Breakup by Distribution Channel:

- Off-Trade

- Independent Retailers

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

- On-Trade

- Food Service

- Vending

Off-trade channel exhibits a clear dominance as supermarkets, convenience stores, and online platforms provide easy accessibility and convenience for purchasing RTD beverages.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific holds the leading position owing to high consumption in countries like Japan and China, where tea has cultural significance and increasing urbanization boosts demand for RTD beverages.

Ready to Drink Tea and Coffee Trends:

The ready-to-drink tea and coffee market is evolving. This shift is due to changing consumer preferences. In 2024, there’s a growing demand for tasty, functional drinks. People want beverages that also boost health. Products with probiotics and herbal extracts are becoming popular. These ingredients aim to enhance well-being. Social media and wellness influencers are key drivers. They push for unique flavors and artisanal blends. This trend forces brands to innovate. Sustainability is also crucial. Consumers are more aware of environmental impacts. This awareness shapes product development and marketing. The market is adapting to these trends. It aims to stay relevant and appealing to a wide audience.

Who are the key players operating in the industry?

The report covers the major market players including:

- Asahi Breweries

- Dr Pepper Snapple Group

- Starbucks

- Pepsico

- The Coca Cola Company

- Ajinomoto General Foods Inc.

- Ting Hsin International Group

- Uni-President Enterprises Corporation

- Nestlé

- Dunkin’ Brands

- Ferolito Vultaggio & Sons

- Keurig Dr Pepper

- Hangzhou Wahaha Group

- Lotte Chilsung

- Monster Beverage

- Acqua Minerale San Benedetto

- Kirin Holdings Company

- Unilever

- Arizona Beverage Company

- Suntory

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=1594&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145