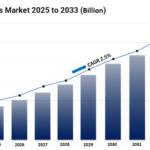

The global Buy Now Pay Later (BNPL) market is a dynamic and promising sector that has witnessed significant growth in recent years. According to a recent market study by Extrapolate, the BNPL market was valued at $24.12 billion in 2022 and is projected to reach $115.27 billion by 2030. This remarkable expansion, driven by a compound annual growth rate (CAGR) of 21.76% over the forecast period of 2022 to 2030, highlights the immense potential of this sector. This report provides a comprehensive overview of the BNPL market, covering its growth drivers, key segments, regional insights, and competitive landscape. It serves as an invaluable resource for businesses, investors, and industry professionals aiming to capitalize on emerging opportunities and navigate market uncertainties.

Competitive Landscape

The BNPL market is characterized by intense competition, with numerous key players striving to strengthen their positions through various strategies. These strategies include organic approaches like product innovation and customer experience enhancement, as well as inorganic tactics such as mergers, acquisitions, and partnerships. By analyzing these approaches, stakeholders can gain valuable insights into market dynamics.

Key Companies in the BNPL Market:

- Affirm, Inc.

- Klarna Inc.

- Amazon

- Sezzle

- Perpay Inc.

- Zip Co Limited

- PayPal Holdings, Inc.

- AfterPay Limited

- Openpay

- LatitudePay

These companies are at the forefront of innovation, leveraging technology to enhance customer experiences and streamline payment processes. Their strategies and focus on meeting consumer demand make them pivotal players in this fast-evolving market.

Market Overview

The BNPL market has demonstrated remarkable growth, driven by several critical factors. Understanding these growth drivers is essential for businesses aiming to adapt proactively and identify new avenues for expansion.

Growth Drivers:

- Technological Innovations: Advancements in financial technology (fintech) have simplified the adoption of BNPL services, making them accessible to a broader consumer base.

- Changing Consumer Preferences: Consumers increasingly prefer flexible payment options, especially among younger demographics.

- Government Initiatives: Supportive policies and regulations promoting cashless economies have further fueled market growth.

- E-commerce Boom: The rapid growth of online shopping has significantly contributed to the widespread adoption of BNPL services.

The report also highlights potential challenges such as evolving regulatory frameworks and economic fluctuations. By addressing these risks, businesses can ensure resilience and sustained growth in a competitive environment.

Segmental Analysis

The BNPL market is segmented based on channel, enterprise size, end user, and geographical region. This segmentation allows businesses to target specific customer groups and optimize their strategies.

By Channel:

- Online: The dominant channel, driven by the surge in e-commerce and digital transactions.

- Point of Sale (POS): Gaining traction in physical retail stores as an alternative payment option.

By Enterprise Size:

- Large Enterprises: Leveraging BNPL services to enhance customer loyalty and drive sales.

- Small & Medium Enterprises (SMEs): Adopting BNPL solutions to attract cost-conscious consumers and compete with larger players.

By End User:

- Healthcare: BNPL services are increasingly used for financing medical treatments and procedures.

- Retail: A key driver of BNPL adoption, offering consumers flexible payment options for goods and services.

- Leisure & Entertainment: Enhancing affordability for travel, events, and entertainment purchases.

- Automotive: Providing financing options for vehicle purchases and related services.

- Others: Includes education, utilities, and other niche applications.

Regional Insights

The BNPL market spans several key regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Each region offers unique opportunities and challenges, shaped by consumer behavior, regulatory environments, and market maturity.

- North America: A mature market with high consumer adoption rates, driven by established players and innovative startups.

- Europe: Focused on regulatory compliance and consumer protection, fostering trust and widespread adoption.

- Asia-Pacific: Rapid economic growth and increasing smartphone penetration make this region a significant growth driver for the BNPL market.

- Latin America: Emerging markets with growing digital infrastructure and untapped potential.

- Middle East & Africa: Expansion fueled by increasing e-commerce activity and a shift toward cashless payment systems.

-

- North America: A mature market with high consumer adoption rates, driven by established players and innovative startups.

- Europe: Focused on regulatory compliance and consumer protection, fostering trust and widespread adoption.

- Asia-Pacific: Rapid economic growth and increasing smartphone penetration make this region a significant growth driver for the BNPL market.

- Latin America: Emerging markets with growing digital infrastructure and untapped potential.

- Middle East & Africa: Expansion fueled by increasing e-commerce activity and a shift toward cashless payment systems.

The BNPL market spans several key regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Each region offers unique opportunities and challenges, shaped by consumer behavior, regulatory environments, and market maturity.

Understanding these regional dynamics enables businesses and investors to tailor their strategies to enhance market presence and capitalize on region-specific opportunities.

Conclusion

The global Buy Now Pay Later market is poised for substantial growth, driven by technological advancements, changing consumer preferences, and supportive government initiatives. With its flexibility and accessibility, BNPL is revolutionizing the payment landscape, making it an indispensable tool for consumers and businesses alike. The Extrapolate report provides an in-depth analysis of market trends, competitive landscapes, and regional dynamics, equipping stakeholders with the insights needed to succeed in this rapidly evolving industry.

For detailed insights and further information, visit: Extrapolate BNPL Market Report.