Aeroengine Composites Market 2024-2032:

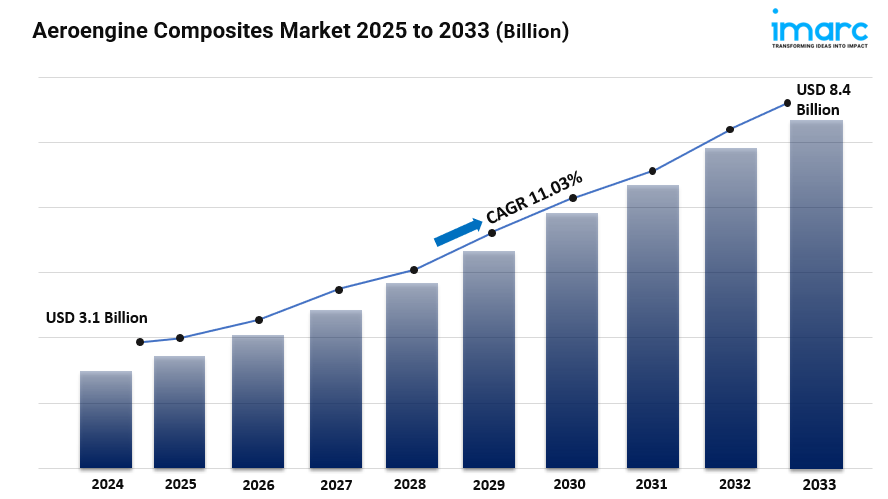

- The global aeroengine composites market size reached USD 3.1 Billion in 2024.

- The market is expected to reach USD 8.4 Billion by 2033, exhibiting a growth rate (CAGR) of 11.03% during 2025-2033.

- North America leads, accounting for the majority of the market share owing to strong defense contracts and technological advancements in aerospace manufacturing.

- Fan blades represent the largest segment due to their critical impact on engine efficiency and noise reduction technologies.

- Polymer matrix composites represent the biggest segment spurred by their increasing adoption in next-generation aeroengine designs for enhanced performance.

- Commercial aircraft hold the largest share in the industry, driven by rising passenger traffic and the demand for fleet modernization globally.

- The growth of the aeroengine composites market is significantly driven by the increasing emphasis on weight reduction and enhanced operational performance.

- Additionally, the rising trend of retrofitting older aircraft with modern, lightweight materials is propelling the market demand, as operators aim to meet contemporary efficiency standards without investing in new fleets.

Request for a sample copy of this report: https://www.imarcgroup.com/aeroengine-composites-market/requestsample

Industry Trends and Drivers:

- Demand for fuel efficiency:

The aerospace industry is under constant pressure to enhance fuel efficiency and reduce operating costs. Composites, particularly carbon fiber-reinforced polymers, offer substantial weight savings compared to traditional metallic materials. A lighter aeroengine translates into lower fuel consumption, thereby improving the overall efficiency of aircraft. As airlines seek to minimize expenses in a highly competitive market, the integration of composite materials into aeroengines becomes increasingly attractive. The need for more efficient aircraft to meet the growing air traffic demands further fuels the adoption of advanced composite materials in engine designs.

- Advancements in material technology:

Recent innovations in composite materials have expanded their applications in aeroengine manufacturing. The development of high-temperature-resistant composites allows for their use in critical components, such as turbine blades and cases, which traditionally relied on heavy metals. These new materials can withstand extreme operating conditions while offering enhanced performance characteristics. Furthermore, advancements in manufacturing processes, such as automated fiber placement and additive manufacturing, have improved the precision and scalability of composite production, making it more viable for large-scale aeroengine applications. These technological improvements are essential for maintaining competitive advantages in the aerospace sector.

- Increasing regulations for environmental sustainability:

Governments and international organizations are implementing stringent regulations aimed at reducing carbon emissions and improving the environmental footprint of the aviation industry. The use of lightweight composites in aeroengines significantly contributes to lower emissions by enhancing fuel efficiency. In response to growing public concern about climate change and environmental impact, aerospace manufacturers are prioritizing the development of greener technologies. The shift towards sustainable aviation fuels (SAFs) and electric propulsion systems also requires lightweight engine components, further driving the demand for composite materials. As regulatory bodies continue to push for sustainability, the pressure on manufacturers to innovate and integrate advanced composites into aeroengine designs intensifies.

Aeroengine Composites Market Report Segmentation:

We explore the factors propelling the aeroengine composites market growth, including technological advancements, consumer behaviors, and regulatory changes.

Breakup By Component:

- Fan Blades

- Fan Case

- Guide Vanes

- Shrouds

- Others

Fan blades represent the largest segment due to their critical role in engine performance and efficiency, benefiting significantly from the lightweight properties of composite materials.

Breakup By Composite Type:

- Polymer Matrix Composites

- Ceramic Matrix Composites

- Metal Matrix Composites

Polymer matrix composites dominate the market due to their excellent strength-to-weight ratio, corrosion resistance, and versatility, making them ideal for various aeroengine components.

Breakup By Application:

- Commercial Aircraft

- Military Aircraft

- General Aviation Aircraft

The commercial aircraft segment holds the largest market share, driven by the increasing demand for air travel and the need for fuel-efficient and environmentally friendly aircraft designs.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America is the largest market, supported by a robust aerospace industry, significant investments in research and development (R&D), and the presence of leading aircraft manufacturers and suppliers of composite materials.

Top Aeroengine Composites Market Leaders:

The aeroengine composites market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Albany International Corp.

- GKN Aerospace Services Limited

- Hexcel Corporation

- Meggitt Plc (Parker Hannifin Corporation)

- Rolls-Royce Plc

Ask Analyst & Browse full report with TOC List of Figures: https://www.imarcgroup.com/request?type=report&id=7415&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145