Saudi Arabia experienced changes recently in which financial transactions transformed significantly, mainly through the technological advancement and subsequent restrictive regulations. This government move made it necessary for every Saudi business to have proper e-invoicing due to the Zakat-Tax and Customs Authority (ZATCA) mandatory requirements. E-invoicing software Saudi Arabia works towards making incoming invoices while satisfying the government on the one side and increasing efficiency at the operational level on the other. Saudi Businesses can then have ample time for growth since they would not have to worry over little tasks such as tax calculation and invoice layout, yet their financial operations will remain accurate and transparent.

One must comply with the regulations to manage an efficient day-to-day financial operation for all Saudi companies. In addition, e-invoicing or electronic invoicing representation is one significant remedy that can solve both problems and bring cutting-edge solutions that embrace businesses for a competitive edge. It covers VAT calculations, digital signatures, and other requirements while generating invoices. The system tracks invoices in real-time and provides secure storage that eliminates or minimizes risks of penalties and fraud. For a Saudi business that would like to progress in the digital years, investing in e-invoicing software is more than a compliance measure; it is an investment into accuracy, security, and efficiency within a financial management system.

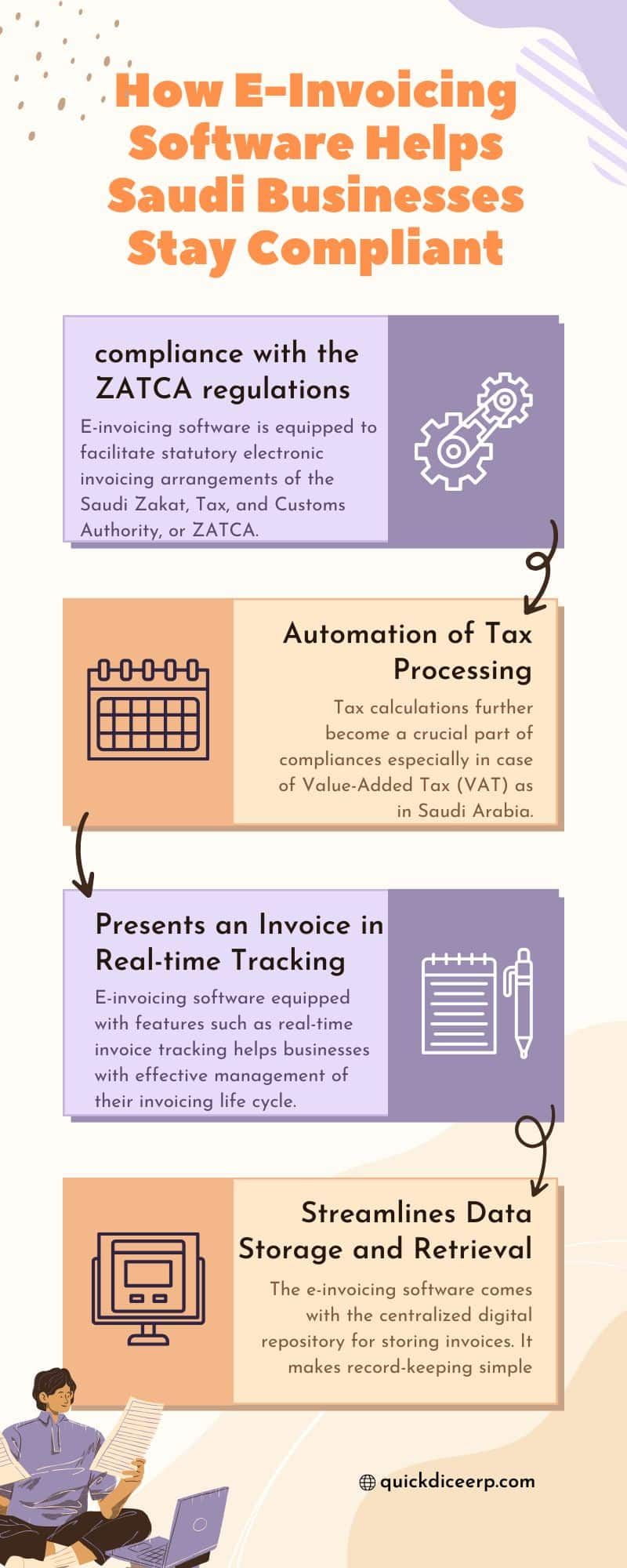

Here are some ways e-invoicing software helps Saudi Businesses stay compliant

1. It guarantees compliance with the ZATCA regulations.

E-invoicing software is equipped to facilitate statutory electronic invoicing arrangements of the Saudi Zakat, Tax, and Customs Authority, or ZATCA. Such systems automatically format invoices to the mandated structure complete with fields such as VAT details and its unique identifier. It brings down the errors and penalties to a great extent by automating compliance.

2. Automation of Tax Processing

Tax calculations further become a crucial part of compliances especially in case of Value-Added Tax (VAT) as in Saudi Arabia. E-invoicing software eliminates manual errors in determining tax. It provides every invoice with a precise application of VAT and allows easy use for proper tax records during auditing and reporting.

3. It Presents an Invoice in Real-time Tracking

E-invoicing software equipped with features such as real-time invoice tracking helps businesses with effective management of their invoicing life cycle. This not only inflates the timely preparation and reception of invoices but also makes the reporting process seamless for ZATCA. Real-time tracking enables contributing to the transparency and minimizes discrepancies that come about in financial transactions.

4. Streamlines Data Storage and Retrieval.

The e-invoicing software comes with the centralized digital repository for storing invoices. It makes record-keeping simple and secure storage for mandated retention periods. The quick retrieval features add ease to audits, hence saving time and resources for business against ZATCA requirements.

5. Improves Fraud Prevention.

E-invoicing systems have digital signature and encryption functions that prevent unauthorized alterations of invoices. Thus, every transaction is secure and authentic. Lessen the risk of fraud so that enterprises can easily meet and maintain regulatory requirements.

6. Reduces Administrative Burden.

Manual invoicing processes are time-consuming and prone to errors. E-invoicing software would take up these tasks, freeing administrative resources to focus business efforts on strategy with the confidence of abiding by the laws of Saudi Arabia.

7. Improves Cross-Border Trade Compliance.

E-invoicing software is also multi-currency and multi-lingual for all businesses in international trade, complying with ZATCA and international invoicing standards, and making it easy for cross-border transactions to take place.

Conclusion

E-invoicing software in Saudi Arabia is a highly sought-after solution for businesses that require accuracy and ease to regulatory compliance. This technology automates complex processes like VAT compliance and invoice validation, thus reducing human error and adherence to regulations set forth by ZATCA. These enable Saudi businesses to create digital invoices they can print at meet legal requirements besides avoiding penalties; it instills trust with governmental authorities and clients. Through the dynamic changes in legislation, e-invoicing software provides Saudi businesses with information on seamless compliance within ever-changing finances.

Of course, regulation, but also e-invoicing software, enables Saudi Arabia to improve the financial flow in the organization and boost total productivity. Real-time invoice tracking, secure data storage, and even integration with existing ERP solutions help lessen administrative burdens and amplify productivity in their operation. Without forgetting, indeed, that these systems enable transparency and the ability to pinpoint financial changes and make sound decisions. For Saudi businesses seeking to grow sustainably, e-invoicing software is not just a compliance tool; it is a growth, innovation, and success enabler for tomorrow and beyond.

E-invoicing software is crucial for Saudi businesses to stay compliant with regulations, but it also offers significant benefits in improving financial flow and overall productivity. By automating invoicing processes, companies can streamline operations and reduce manual tasks, leading to more efficient financial management.

One of the key advantages of e-invoicing software is real-time invoice tracking and secure data storage. These features not only enhance transparency but also reduce the administrative burden, allowing businesses to focus on core activities. Furthermore, integration with existing ERP solutions ensures a seamless transition to digital invoicing, boosting operational efficiency.

For Saudi businesses aiming for sustainable growth, e-invoicing software goes beyond compliance. It serves as a tool for innovation and strategic decision-making by providing clear insights into financial changes. This enables companies to make informed decisions, driving growth and success in a competitive market.