IMARC Group, a leading market research company, has recently releases report titled “Petroleum Coke Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033,” The study provides a detailed analysis of the industry, including the global Petroleum Coke Market trends, share, size, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

How Big Is the Petroleum Coke Market?

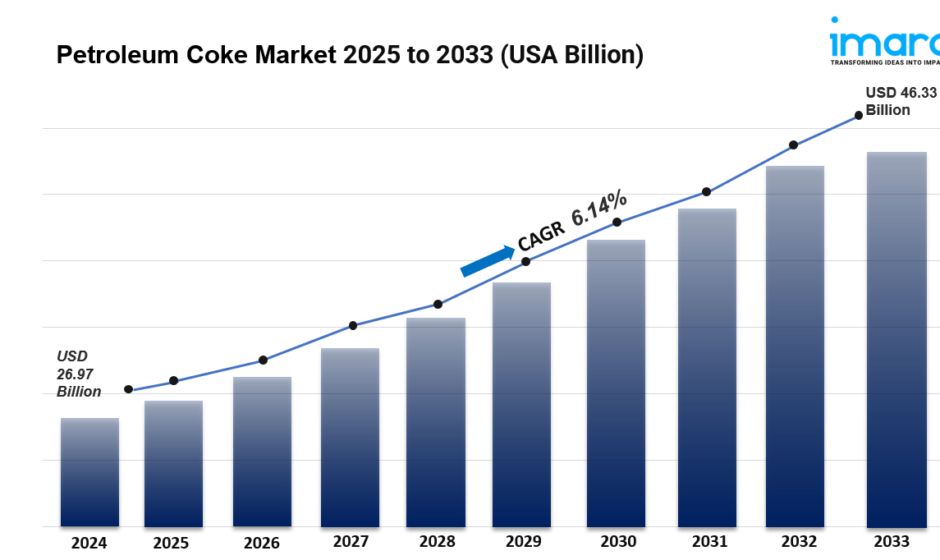

The global petroleum coke market size was valued at USD 26.97 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.33 Billion by 2033, exhibiting a CAGR of 6.14% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 45.1% in 2024. The market growth is driven by the increasing demand from the aluminum industry, the expanding power generation sectors, and the rising use of petroleum coke as a cost-effective fuel alternative in various industries. Collectively, these factors are increasing the petroleum coke market share across the globe.

Global Petroleum Coke Market Trends:

The petroleum coke market will change as industries adapt to new economic, environmental, and technological trends. With a focus on innovation and sustainability, we expect significant improvements in product quality and application versatility. By 2025, demand for petroleum coke is likely to rise. This is due to its key role in aluminum production, power generation, and cement manufacturing. Companies see the value in sourcing high-quality petroleum coke that meets their sustainability goals and complies with strict environmental regulations. Advances in processing technologies are producing specialized grades of petroleum coke for specific industry needs. This enhances its competitiveness. As industries shift toward cleaner energy solutions, the petroleum coke market must adapt to these trends. Innovation and collaboration among stakeholders will be essential to face challenges in this rapidly changing landscape. The future of the petroleum coke market will be shaped by demand, regulatory pressures, and technological advances. It’s a dynamic space to watch in the coming years.

Factors Affecting the Growth of the Petroleum Coke Industry:

Growing Demand from the Aluminum Industry:

The petroleum coke market is seeing a big rise in demand, especially from the aluminum industry. This sector is a major user of calcined petroleum coke. As global aluminum production increases to meet needs from automotive, construction, and packaging, the demand for high-quality petroleum coke grows. This material is essential as an anode in aluminum smelting. The aluminum industry’s move towards sustainable practices boosts the need for petroleum coke that meets strict quality standards. Cleaner energy sources and better recycling methods are part of this shift. Also, the growth of aluminum production facilities in emerging markets will help the petroleum coke market expand. As companies focus on improving efficiency and reducing environmental impact, the demand for high-grade petroleum coke will rise. This makes it a key player in the aluminum production process.

Environmental Regulations and Sustainability Initiatives:

Environmental regulations are shaping the petroleum coke market. Governments worldwide are enforcing stricter emissions standards and sustainability goals. The burning of petroleum coke, especially for power and industry, raises air quality and greenhouse gas concerns. In response, companies are seeking cleaner alternatives and technologies to reduce the environmental impact. This shift is pushing the market to focus on lower-sulfur and more eco-friendly grades of petroleum coke. Additionally, industries are investing in carbon capture and storage (CCS) technologies to cut emissions from petroleum coke combustion. As sustainability becomes vital to business strategies, the petroleum coke market must adapt to meet regulations and the growing demand for greener energy sources. This situation creates both challenges and opportunities for producers and consumers. They must balance economic viability with environmental responsibility.

Price Volatility and Global Supply Chain Dynamics:

Price volatility in the petroleum coke market is affected by several factors. These include changes in crude oil prices, supply chain disruptions, and geopolitical tensions. Because the global oil market is interconnected, shifts in crude oil prices can directly impact petroleum coke production costs. Supply chain issues from natural disasters, trade disputes, or logistical problems can also cause significant price changes. This affects how available and affordable petroleum coke is for users. As industries depend more on petroleum coke for energy and manufacturing, this price volatility can create uncertainty and hurt profits. To manage these risks, companies are focusing on strategic sourcing, long-term contracts, and diversifying supply chains. Navigating these challenges while keeping prices stable will be key for stakeholders in the petroleum coke market, especially as demand grows in various sectors.

Request for a sample copy of this report: https://www.imarcgroup.com/petroleum-coke-market/requestsample

Petroleum Coke Industry Segmentation:

Analysis by Type:

- Fuel Grade Coke

- Calcined Coke

Fuel grade coke stand as the largest component in 2024, holding around 50.9% of the market.

Analysis by Application:

- Power Plants

- Cement Kilns

- Steel

- Aluminum

- Fertilizer

- Others

Aluminum leads the market with around 37.81% of the market share in 2024.

Regional Analysis:

- North America

- Asia

- Europe

- Latin America

- Middle East and Africa

North America leads the market in 2024 with over 41.2% share, driven by advanced technology infrastructure, strong regulatory frameworks, and a high volume of M&A activities, fueling demand for secure VDR solutions.

Top Petroleum Coke Market Leaders:

The petroleum coke market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some Of the Key Players In The Market Are:

- BP Plc

- Chevron Corporation

- ConocoPhillips

- Exxon Mobil Corporation

- HPCL – Mittal Energy Limited

- Indian Oil Corporation Ltd.

- Marathon Petroleum Corporation

- Royal Dutch Shell PLC

- Saudi Arabian Oil Co.

- Trammo Inc.

- Valero Energy Corporation

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=2592&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Related Post: https://fastpanda.in/2025/03/18/cold-brew-coffee-market-is-expected-to-grow-usd-10-0-billion-by-2033/