Europe Organic Food Market Size, Share & Forecast 2024–2033

Description

The Europe organic food market is poised for strong growth over the forecast period 2024–2033, fueled by rising consumer health consciousness, sustainability concerns, and supportive government policies promoting organic farming. With increasing demand for chemical-free, eco-friendly food, the market presents vast opportunities across product categories and distribution channels.

Table of Contents

- Market Overview

- Key Drivers

- Challenges

- Market Segmentation

- Country Analysis

- Competitive Landscape

- Future Outlook

- Q&A – Europe Organic Food Market

Get Free Sample

[Request your free sample report here.]Europe Organic Food Market Forecast and Opportunities (2024–2033)

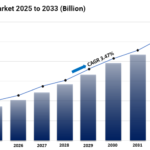

The Europe organic food market is forecasted to reach US$ 146.44 billion by 2033, growing from US$ 60.87 billion in 2024 at a CAGR of 10.25% during the forecast period.

The growth reflects a strong consumer shift toward healthier lifestyles and sustainable food consumption. Increased government initiatives, technological advances in organic farming, and expanded retail channels further support this upward trajectory.

Market Overview

Organic food refers to products produced without synthetic pesticides, chemical fertilizers, genetically modified organisms (GMOs), or artificial additives.

Organic agriculture focuses on promoting soil health, biodiversity, animal welfare, and environmental stewardship.

Europe has emerged as a global leader in organic food consumption. Major countries like Germany, France, Italy, and Spain are leading the charge, backed by:

- Strong consumer demand for clean-label products

- Growth in retail distribution channels

- Favorable EU policies, such as the Farm to Fork strategy aiming for 25% of agricultural land to be organic by 2030.

Key Drivers of the Europe Organic Food Market

- Rising Consumer Health Awareness

Consumers increasingly associate organic food with better health outcomes, leading to greater demand.

ProVeg’s 2023 study revealed that over 51% of Europeans have reduced meat consumption for health and environmental reasons — showcasing a major shift toward organic and plant-based foods.

- Environmental Sustainability and Ethical Farming

Eco-consciousness is a strong motivator among European consumers.

Organic farming’s contribution to reducing carbon footprints, preserving biodiversity, and ensuring animal welfare makes it highly attractive.

- Example:

MeliBio’s partnership with Narayan Foods (2022) introduced plant-based, bee-free honey into 75,000 European stores, showcasing innovation aligned with sustainable practices.

- Expansion of Retail and Online Channels

Supermarkets, specialty stores, and online platforms are rapidly increasing their organic product offerings, enhancing product accessibility.

- EU Green Deal’s Farm to Fork Strategy targets significant increases in organic agricultural land, further boosting supply chain capabilities.

Challenges in the Europe Organic Food Market

- High Price Sensitivity

Organic foods often come with higher retail prices due to expensive production methods and certifications, making affordability a key challenge, especially among low-income groups.

- Supply Chain Complexities

Ensuring consistent quality, traceability, and cross-border regulatory compliance remains a hurdle, particularly given Europe’s diverse certification standards.

Europe Organic Food Market Segmentation

By Product Type:

- Organic Fruits and Vegetables

- Organic Meat, Poultry, and Dairy

- Organic Processed Food

- Organic Bread and Bakery

- Organic Cereal and Food Grains

- Others

By Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenient Stores

- Online Retail Stores

- Others

Country Analysis

France

- Strong emphasis on local, ethical production.

- Government incentives for sustainable agriculture.

- Growing demand across fruits, dairy, meat, and plant-based products.

- Notable development: Roquette’s 2022 launch of organic textured plant proteins.

Germany

- Europe’s largest organic food market.

- Consumer preference for transparency, sustainability, and food safety.

- Broad distribution through supermarkets and specialty health stores.

- Major player: De Groene Weg B.V. supplying organic meat to Germany.

Italy

- High growth in organic fruits, vegetables, olive oil, and meat.

- Strong cultural attachment to high-quality, sustainable food.

- Increasing focus on eco-certifications.

Spain

- Rapid growth driven by rising awareness and government promotion.

- Expansion in organic fruits, vegetables, and plant-based seafood (Nestlé’s Garden Gourmet brand introduction in 2023).

United Kingdom

- Growing demand for organic ready-to-eat meals and convenience organic products.

- Brexit-related regulations shaping a unique organic trade environment.

Other key countries: Belgium, Netherlands, Turkey, and the Rest of Europe are witnessing similar positive trends with minor regulatory and consumption differences.