India Air Conditioner Market Overview

An air conditioner (AC) is a climate control device designed to regulate indoor air temperature, humidity, and air quality. With India’s intense summers and urban heat islands worsening due to climate change, the use of air conditioners is transitioning from being a luxury item to a basic necessity across residential and commercial sectors.

Technological innovations such as inverter technology, smart air conditioners, and eco-friendly refrigerants are reshaping consumer preferences. Rural electrification, rising middle-class incomes, and the growing youth demographic are further bolstering demand across urban and semi-urban regions.

India Air Conditioner Market Trends & Summary

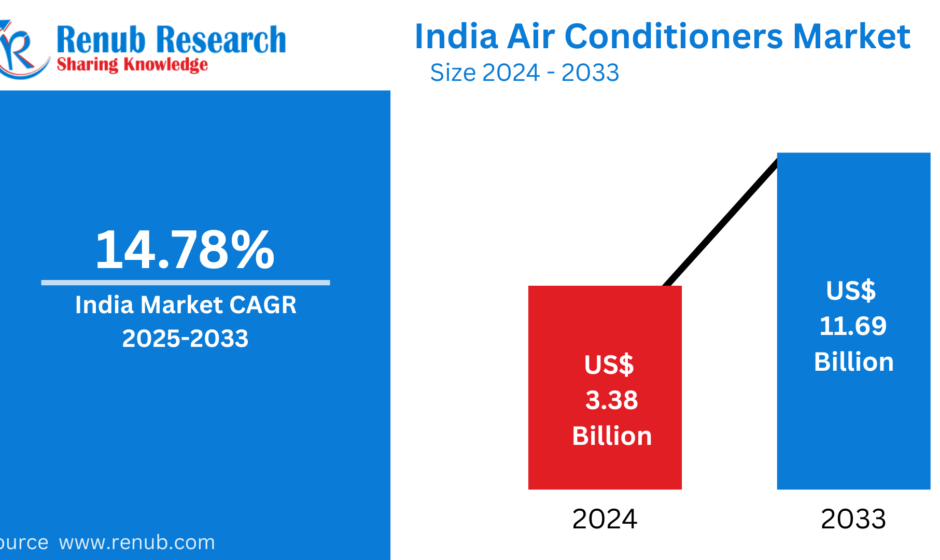

- Market Value 2024: USD 3.88 billion

- Projected Market Value 2033: USD 13.43 billion

- CAGR (2025–2033): 14.78%

- Key Trends:

- Shift toward inverter and energy-efficient ACs.

- Emergence of smart and connected AC solutions.

- Preference for eco-friendly refrigerants (e.g., R-32, R-290).

- Rapid growth of e-commerce sales channels.

- Rising demand for residential and small-office ACs in Tier-II and Tier-III cities.

Growth Drivers of the India Air Conditioner Market

- Increasing Disposable Incomes and Lifestyle Upgradation

Urban migration and dual-income households are redefining consumer behavior.

- Key Question: How are changing aspirational needs influencing AC ownership patterns in emerging cities?

- Escalating Climate Change and Rising Temperatures

Heatwaves in India are becoming more frequent and intense, resulting in skyrocketing cooling demand.

- Example: Rajasthan recorded 50.5°C in 2024, the highest in over a decade.

- Key Question: Can sustainable cooling technologies keep pace with escalating climate demands?

- Government Push for Energy Efficiency

- BEE’s star rating programs and incentives for energy-saving appliances are promoting the adoption of inverter ACs.

- Key Question: How will new government policies such as India Cooling Action Plan (ICAP) impact future product innovation?

Challenges Facing the Market

- High Electricity Costs and Infrastructure Gaps

- Uneven power supply in rural areas remains a challenge.

- Key Question: How can AC manufacturers innovate around low-power consumption solutions for rural markets?

- Price Sensitivity and Hyper Competition

- Heavy discounting and price wars among brands.

- Key Question: Will premium brands find sustainable growth in a highly price-sensitive environment?

Segment Analysis

By Type

- Room Air Conditioners: Dominates residential sales with efficient, easy-to-install solutions.

- Ducted Air Conditioners: Preferred in commercial properties such as malls, hotels.

- Ductless ACs: Gaining ground in modern interiors.

- Centralized ACs: Critical for large office complexes and luxury hotels.

By Product Type

- Split ACs: Lead the market owing to inverter technology adoption.

- Window ACs: Popular for cost-conscious consumers and older apartments.

- Others: Cassette ACs, portable ACs growing for niche segments.

By Size

- 1 Ton: Ideal for small rooms and nuclear families.

- 1.5 Ton: Most preferred segment for mid-sized homes and offices.

- 2 Ton & Others: Commercial spaces and larger rooms.

By Application

- Residential: Dominant, driven by increasing middle-class income.

- Commercial & Retail: Growing due to malls, shops, and office complexes.

- Hospitality: Demand for centralized cooling in hotels and resorts.

- Transportation & Infrastructure: Airports, metros, buses adopting large-scale HVAC systems.

- Healthcare: Mandatory cooling in hospitals and clinics.

By Sales Channel

- Supermarkets and Specialty Stores: Traditional yet dominant.

- Online: Fastest growing, boosted by digital adoption and easy financing options.

Regional Insights

North India

- Hot summers, rapid urbanization, and middle-class expansion fuel demand.

- Delhi NCR, Punjab, and Rajasthan are hotbeds for AC sales.

South India

- Year-round humidity drives steady AC adoption.

- IT hubs like Bengaluru and Hyderabad boost both residential and commercial demand.

East India

- Growth in Kolkata and Odisha, although hampered by relatively lower disposable incomes compared to the west.

West India

- Mumbai, Pune, Ahmedabad are leading cities, with growth also spurred by commercial real estate expansion.

Competitive Landscape and Major Players

- Voltas Limited

- Blue Star Limited

- Havells India Limited

- Whirlpool of India Limited

- Godrej and Boyce Manufacturing Company Limited

- MIRC Electronics Limited

- Johnson Controls-Hitachi Air Conditioning India Limited

Key Competitive Parameters:

- Technological innovation (inverter tech, smart ACs)

- Energy efficiency ratings

- Pricing strategies

- Service network and after-sales support

- Eco-friendly product launches

Conclusion

India’s air conditioner market is poised for robust, sustainable growth over the next decade. Driven by urbanization, climate change, technological advancements, and increased energy awareness, the sector offers immense opportunities across both residential and commercial segments. Strategic pricing, innovation around energy efficiency, and regional market targeting will be crucial for success in India’s dynamic air conditioner industry.