Market Overview:

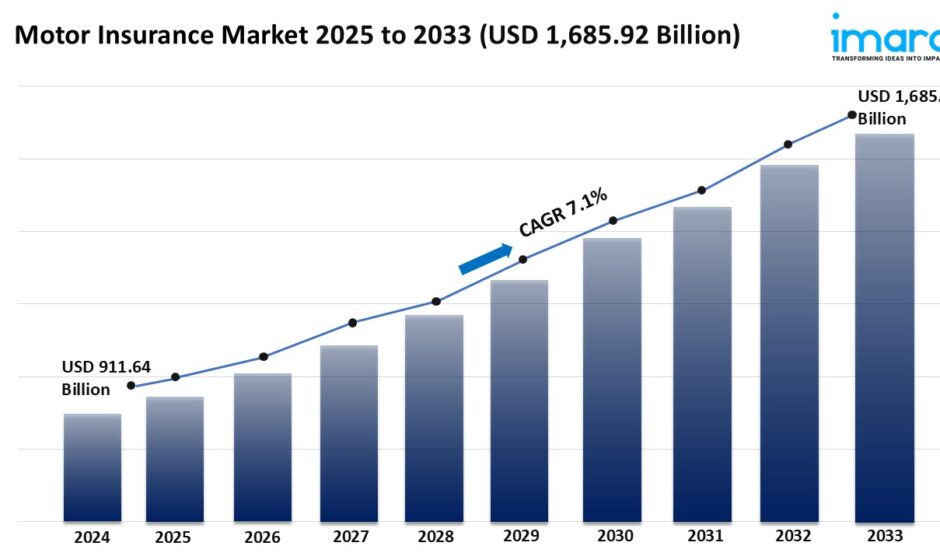

The motor insurance market is experiencing rapid growth, driven by rising claims frequency, shift to digital platforms, and EV adoption impact. According to IMARC Group’s latest research publication, “Motor Insurance Market Size, Share, Trends and Forecast by Policy Type, Premium Type, Distribution Channel, and Region, 2025-2033.” The global motor insurance market size was valued at USD 911.64 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,685.92 Billion by 2033, exhibiting a CAGR of 7.1% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/motor-insurance-market/requestsample

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Motor Insurance Industry:

- Rising Claims Frequency

The motor insurance sector continues to increase claims through higher accident and personal injury claim rates, primarily as a result of distracted driving and congested roadways. The impact of increased claims has put an undue strain on insurers to manage their costs by offering competitive premiums while keeping their customer base happy. Consequently, this trend has led companies to pursue investment strategies into telematics and usage-based insurance policies which address issues like fraud and only pay out for those that drive in a safe manner. With the continued occurrence of more frequent claims, insurers are having to become more creative and balanced in adjusting premiums with competing prices to keep insured clients satisfied.

- Shift to Digital Platforms

Customers now typically want to buy and manage their policies using digital channels, which is driving the pace at which traditional broker models are disappearing. Insurers are using AI-based tools that help to speed up claims processing and foster personalized pricing. Mobile apps and online portals are enhancing the speed at which customers do business with the more agile insurers who have adopted this digital solution and are lowering expense ratios. This digital migration is reshaping competitive dynamics in today’s market favoring insurers with technology capabilities over insurers who are relying on legacy systems.

- EV Adoption Impact

The increasing proliferation of electric vehicles (EVs) is fundamentally changing motor insurance appetite since EVs need unique coverages that cater for the risks associated with the battery and the repair costs. Insurers are working hard to develop products that address these particular types of risk while also trying to get a handle on the uncertain trends that will affect EV repair costs. With EVs gaining traction, there may be some adjustments in premiums that will recognize the new risks involved with insured drivers and vehicles, which together provide an opportunity for insurers to innovate and harness the demands of these new customers.

Leading Companies Operating in the Motor Insurance Industry:

- American International Group Inc.

- Assicurazioni Generali S.p.A.

- AXA Cooperative Insurance Company (Gulf Insurance Company K.S.C.)

- Bajaj Allianz General Insurance Company Limited

- China Ping An Insurance Co. Ltd.

- Government Employees Insurance Company (Berkshire Hathaway Inc.)

- Reliance General Insurance Company Limited (Reliance Capital Limited )

- State Farm Mutual Automobile Insurance Company

- The Hanover Insurance Group Inc. (Opus Investment Management)

- The Progressive Corporation

- Universal Sompo General Insurance Company Limited

- Zurich Insurance Group Ltd.

Motor Insurance Market Report Segmentation:

By Policy Type:

- Liability Insurance

- Comprehensive Coverage

- Collision Coverage

- Personal Injury Protection

Liability insurance is the largest component in 2024 due to its mandatory nature, protecting individuals and businesses from financial losses caused by accidents and increasing demand from rising vehicle ownership.

By Premium Type:

- Personal Insurance Premiums

- Commercial Insurance Premiums

Personal insurance premiums vary based on risks associated with individual car owners, while commercial insurance premiums are generally higher due to the increased risk and specialized coverage needed for vehicle fleets.

By Distribution Channel:

- Insurance Agents/Brokers

- Direct Response

- Banks

- Others

In 2024, insurance agents/brokers dominate the market by providing personalized services and expert advice, helping clients navigate complex policy options, despite the growing popularity of digital platforms.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

In 2024, North America holds the largest market share due to its established infrastructure, high vehicle ownership rates, and mature insurance sector, with strong demand driven by mandatory liability coverage and technological advancements.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145