Global Tax Challenges for Today’s Businesses

In today’s fast-paced business landscape, tax compliance is no longer a seasonal task—it’s a year-round responsibility. As tax regulations continue to evolve and authorities enforce stricter compliance, businesses, especially in the U.S. and globally, face increasing challenges in managing their tax functions internally. From corporate tax returns to individual filings, accuracy and timeliness are essential to avoid penalties and maintain financial health.

Enter tax preparation outsourcing—a strategic solution that’s gaining traction among accounting firms, CPAs, and multinational businesses. By entrusting qualified external professionals to manage tax return preparation, companies not only reduce the workload on internal teams but also ensure accurate, timely, and compliant tax filings. The global shift towards outsourcing tax processes is driven by the dual need for operational efficiency and regulatory assurance.

What Is Tax Preparation Outsourcing?

Tax preparation outsourcing involves engaging third-party service providers—typically based in countries with skilled accounting professionals and cost advantages—to handle the preparation and review of tax returns. These providers work as an extension of your internal tax or finance team, ensuring that filings meet the relevant tax codes and deadlines.

This model is particularly attractive for CPA firms facing seasonal workload spikes, as well as mid-to-large-sized enterprises that manage tax reporting across multiple jurisdictions. Common services include:

-

Preparation and review of federal, state, and local tax returns

-

Filing for individual (1040), corporate (1120), partnership (1065), and trust (1041) tax returns

-

Tax planning and advisory support

-

Audit assistance and documentation management

-

Year-round support for estimated taxes and extensions

Why Businesses Are Embracing Outsourcing Tax Return Preparation

The benefits of outsourcing tax return preparation go beyond just saving money. It is a strategic move that enhances accuracy, compliance, and scalability. Here’s why many businesses are making the switch:

-

Cost Savings: Outsourcing eliminates the need for hiring, training, and retaining full-time tax professionals. Companies only pay for services rendered, and often at a fraction of the cost of local hires.

-

Access to Global Talent: Offshore tax professionals are often trained in international tax standards and use industry-standard tools and software, ensuring high-quality output.

-

Scalability: During peak seasons like the U.S. tax season (January to April), businesses can scale up their tax operations without overburdening in-house staff.

-

Time Efficiency: Internal teams can redirect their focus toward core advisory roles and strategic planning, while external experts handle the technical workload.

-

Accuracy and Compliance: Reputable outsourcing partners are well-versed in local and international tax laws and provide built-in checks and review processes to reduce errors.

-

Security and Confidentiality: Established providers follow international standards for data protection, including secure file sharing, encrypted communications, and GDPR or SOC 2 compliance.

How the Outsourcing Process Works

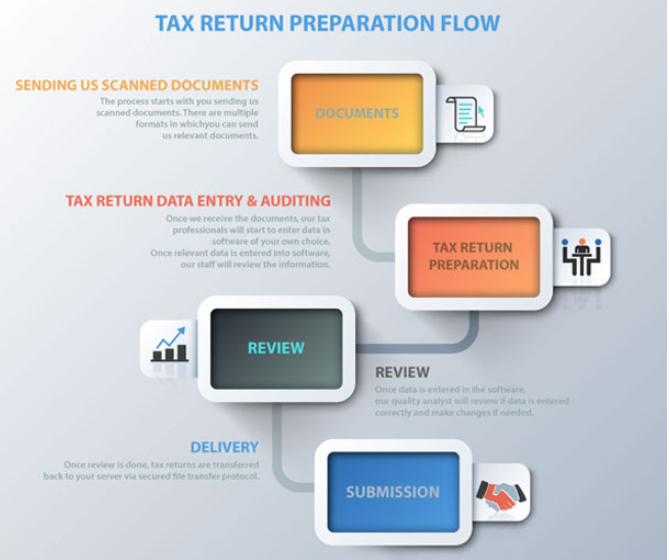

The process of tax preparation outsourcing is designed to be seamless and collaborative:

-

Data Transfer: Clients securely upload tax documents and relevant data through encrypted portals or file-sharing systems.

-

Tax Preparation: The outsourcing team prepares the tax return based on the provided information, using client-specific formats and software.

-

Review and Approval: The draft return is reviewed by a senior tax professional and then submitted to the client for approval.

-

Final Submission: Once approved, the client files the return directly or authorizes the outsourcing partner to file it on their behalf.

-

Post-Filing Support: Support continues after filing, covering queries, audits, and notices from tax authorities.

India as a Global Tax Outsourcing Hub

India has emerged as a leading destination for tax and accounting outsourcing. With a large pool of qualified professionals, extensive experience with international clients, and a deep understanding of U.S. GAAP, IRS standards, and other global tax frameworks, India offers unmatched value in this space.

Engaging an Indian partner for tax preparation outsourcing not only reduces costs but also brings the added benefit of time-zone advantages—allowing for overnight turnarounds and faster service delivery.

Choosing the Right Outsourcing Partner

Selecting a qualified and reliable outsourcing partner is critical. Look for the following attributes:

-

Strong experience with U.S. tax codes and international tax structures

-

Transparent communication and real-time status updates

-

Secure IT infrastructure and data protection policies

-

A collaborative approach with dedicated client service managers

-

Flexible engagement models to suit short-term or long-term needs

One such provider with a strong reputation is AKM Global, a leading consultancy headquartered in the UK with a robust presence in India. AKM Global offers customized tax return preparation services to accounting firms and businesses across the U.S. and Europe. Their blend of local expertise, international knowledge, and secure digital processes makes them a trusted partner for firms looking to streamline their tax function.

When to Consider Outsourcing Tax Preparation

Outsourcing may be the right choice for your business if:

-

Your internal team is overwhelmed during tax season

-

You’re expanding globally and need expertise across jurisdictions

-

Your firm is seeking cost-effective ways to grow its service offerings

-

You want to reduce the risk of compliance errors and late filings

-

You’re looking to free up senior professionals for high-value advisory roles

Conclusion: Stay Compliant, Competitive, and Confident

In an increasingly complex tax environment, accuracy, timeliness, and strategic insight are essential. Tax preparation outsourcing empowers businesses and accounting firms to manage their compliance burden more effectively, while unlocking capacity for strategic growth.

By outsourcing tax return preparation to experienced professionals, you ensure your filings are in capable hands—boosting your operational efficiency, reducing risk, and enhancing the overall quality of your financial reporting. As global business becomes more dynamic, outsourcing is not just a smart move—it’s a strategic imperative.