Key Market Highlights:

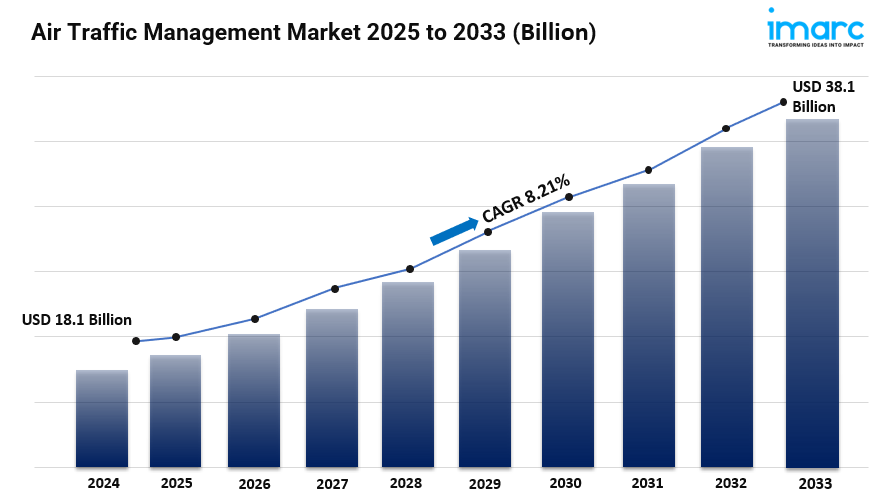

- Air Traffic Management Market Size (2024): Valued at USD 18.08 Billion.

- Air Traffic Management Market Forecast (2025–2033): The air traffic management market is expected to reach USD 38.11 Billion by 2033, growing at a CAGR of 8.21%.

- Market Growth: The air traffic management market is experiencing robust growth, driven by increasing global air travel and demand for efficient airspace utilization.

- Target Demographics: Primarily serves civil aviation authorities, airport operators, airline companies, and military aviation sectors.

- Product Variety: Includes communication, navigation, surveillance (CNS) systems, air traffic control (ATC) solutions, and aeronautical information management systems.

- Technology Trends: Integration of AI, automation, satellite-based navigation, and digital tower systems is enhancing operational efficiency and safety.

- Distribution Channels: Solutions are delivered through direct contracts with governments, aviation agencies, and system integrators.

- Regulatory Landscape: Governed by international aviation standards set by ICAO, FAA, EASA, and regional authorities to ensure compliance and interoperability.

Request for a sample copy of the report: https://www.imarcgroup.com/air-traffic-management-market/requestsample

- Air Traffic Management Market Trends:

Surge in Air Travel and Pressure on Airspace Capacity

The global aviation sector is witnessing a sharp rebound in passenger and cargo traffic, placing increased pressure on airspace infrastructure and management systems. Airports and air navigation service providers (ANSPs) are striving to improve air traffic flow efficiency, reduce delays, and ensure safety amid rising volumes. By 2025, this surge in air traffic will require the modernization of ATM systems, particularly in high-density regions such as North America, Europe, and Asia-Pacific. To meet this demand, governments and aviation authorities are investing in next-generation air traffic control technologies, such as automated flight data processing, collaborative decision-making (CDM), and enhanced airspace design. These efforts aim to optimize route planning, minimize congestion, and reduce carbon emissions from prolonged taxiing and airborne holding patterns. The growing complexity of global airspace management is driving the need for scalable, integrated solutions that allow seamless coordination between civil and military air operations, making ATM upgrades a strategic imperative.

Integration of Digital and Satellite-Based Navigation Systems

The evolution of ATM is increasingly centered around the transition from traditional radar-based surveillance to advanced satellite-based communication, navigation, and surveillance (CNS) systems. Technologies such as Automatic Dependent Surveillance–Broadcast (ADS-B), Performance-Based Navigation (PBN), and satellite communication (SATCOM) are revolutionizing how aircraft are tracked and managed. By 2025, these digital and space-based tools will enable more precise navigation, reduced separation minima, and optimized flight paths across international airspace. This shift supports more efficient fuel usage, greater route flexibility, and enhanced situational awareness for air traffic controllers and pilots alike. The deployment of satellite systems like Europe’s SESAR and the U.S. NextGen framework is setting the benchmark for global ATM modernization. These advancements are also critical for accommodating the growing number of unmanned aerial vehicles (UAVs) and commercial drones entering controlled airspace. The increasing reliance on space-based infrastructure is redefining global air traffic coordination and paving the way for more dynamic and resilient airspace management.

Growing Emphasis on Automation and AI-Driven Air Traffic Solutions

Automation and artificial intelligence are playing transformative roles in the development of next-generation air traffic management systems. The traditional model of manual control and human decision-making is being enhanced by intelligent algorithms capable of handling large-scale airspace data, detecting anomalies, and optimizing traffic flow. By 2025, AI-powered tools such as predictive analytics, machine learning-based traffic forecasting, and autonomous conflict detection are expected to be widely integrated into ATM operations. These technologies improve real-time decision-making, reduce controller workload, and enhance response times during emergencies or traffic surges. Additionally, digital twin platforms are being developed to simulate airspace conditions, enabling proactive planning and faster deployment of traffic rerouting strategies. Automation is also critical in enabling remote and digital air traffic control towers, particularly for regional airports looking to reduce costs without compromising safety. As the aviation industry seeks to improve capacity, safety, and environmental sustainability, AI-driven ATM systems will become essential to maintaining operational excellence.

Industry Segmentation:

Analysis by Domain:

- Air Traffic Control

- Air Traffic Flow Management

- Aeronautical Information Management

Analysis by Component:

- Hardware

- Software

Analysis by Application:

- Communication

- Navigation

- Surveillance

- Automation

Analysis by End User:

- Commercial

- Military

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Adacel Technologies Limited

- Advanced Navigation and Positioning Corporation

- Airbus SE

- Honeywell International Inc.

- Indra Sistemas S.A.

- L3Harris Technologies Inc.

- Leidos

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- Thales Group

Ask Analyst & Browse full report with TOC List of Figures: https://www.imarcgroup.com/request?type=report&id=4656&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Maximize Safety with Electrical Compliance Consulting: Your Essential Guide – Fastpanda 23 Jun 2025

[…] are typically recommended every 5–10 years or after renovations, as advised by Electrical Compliance Consulting. Local regulations may […]