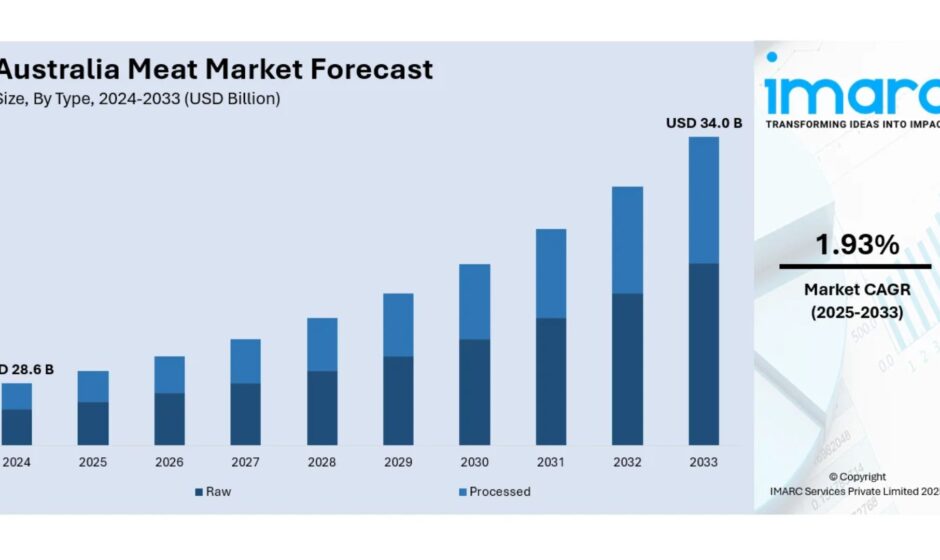

The latest report by IMARC Group, titled “Australia Meat Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033,” offers a comprehensive analysis of the Australia meat market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia meat market size reached USD 28.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 34.0 Billion by 2033, exhibiting a growth rate (CAGR) of 1.93% during 2025–2033.

Base Year: 2024

Forecast Years: 2025–2033

Historical Years: 2019–2024

Market Size in 2024: USD 28.6 Billion

Market Forecast in 2033: USD 34.0 Billion

Market Growth Rate 2025–2033: 1.93%

Request For Sample Report:

https://www.imarcgroup.com/australia-meat-market/requestsample

Australia Meat Market Overview

- The advertise is growing as solid residential request and trade development are supporting in general industry execution.

- Makers are receiving progressed meat preparing innovations to progress quality, security, and effectiveness.

- Supportability activities and creature welfare directions are forming generation hones and item situating.

- Free exchange understandings and rising protein utilization are upgrading Australia’s worldwide meat exchange.

- Retailers are expanding their premium and natural meat offerings to meet advancing buyer inclinations.

- Climate conditions and bolster costs are affecting supply elements and estimating within the Australia meat advertise.

Key Features and Trends of Australia Meat Market

- The showcase is seeing a surge in request for premium, grass-fed, and natural meat items, particularly among health-conscious customers.

- Item labeling is getting to be more straightforward, emphasizing moral sourcing, traceability, and common nourishing hones.

- Export-ready and traceable meats are picking up footing, driven by worldwide request for nourishment security and quality affirmation.

- Plant-based and crossover meat options are rising, catering to flexitarians and sustainability-focused buyers.

- Retailers are improving with certification and QR-coded bundling to improve shopper believe and item straightforwardness.

Growth Drivers of Australia Meat Market

- Solid residential request and rising protein utilization are fueling advertise development.

- Trade development is bolstered by Australia’s notoriety for clean, green, and high-quality meat.

- Free exchange assentions are opening unused worldwide markets and boosting send out volumes.

- Progressed handling innovations and advancement in item groups are moving forward competitiveness.

- Developing shopper intrigued in wellbeing, maintainability, and creature welfare is driving premiumization and item enhancement.

Innovation & Market Demand of Australia Meat Market

-

The market is embracing premium and specialty meats, including grass-fed and Wagyu beef, to meet rising demand for quality and differentiation.

-

Producers are integrating traceability technologies, such as QR codes, to provide end-to-end transparency from paddock to packaging.

-

Plant-based and hybrid meat products are gaining shelf space, offering consumers more sustainable and health-oriented options.

-

Retailers are expanding certified and traceable product ranges, focusing on responsible sourcing and excellence.

-

Exporters are leveraging Australia’s clean and green image to access high-value international markets.

Australia Meat Market Opportunities and Challenges

-

Opportunities are emerging from expanding export markets, especially in Asia and the Middle East, where demand for traceable, high-quality meat is rising.

-

The growth of plant-based and hybrid alternatives is diversifying the market and attracting new consumer segments.

-

Challenges include managing climate variability, feed costs, and compliance with evolving animal welfare and sustainability standards.

-

Intensifying competition among producers is driving innovation and quality improvements.

-

Maintaining Australia’s reputation for food safety and premium quality remains a strategic priority.

Australia Meat Market Analysis

-

The market is segmented by type into raw and processed meat, reflecting diverse consumer preferences.

-

Product segmentation includes chicken, beef, pork, mutton, and others, catering to a broad spectrum of dietary habits.

-

Distribution channels encompass supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

-

Regional analysis covers Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

-

Competitive landscape analysis highlights market structure, key player positioning, and top winning strategies.

Australia Meat Market Segmentation:

By Type:

-

Raw

-

Processed

By Product:

-

Chicken

-

Beef

-

Pork

-

Mutton

-

Others

By Distribution Channel:

-

Supermarkets and Hypermarkets

-

Departmental Stores

-

Specialty Stores

-

Online Stores

-

Others

By Region:

-

Australia Capital Territory & New South Wales

-

Victoria & Tasmania

-

Queensland

-

Northern Territory & Southern Australia

-

Western Australia

Australia Meat Market News & Recent Developments:

-

In February 2025, Jack’s Creek introduced its premium Wagyu X range of beef into the UK, following a 120% rise in interest for Wagyu beef.

-

In September 2024, vEEF launched a carbon-neutral range of plant-based meats, expanding sustainable options in major supermarkets.

Australia Meat Market Key Players:

-

JBS Australia

-

Teys Australia

-

Australian Agricultural Company

-

NH Foods Australia

-

Thomas Foods International

-

Fletcher International Exports

Key Highlights of the Report:

-

Market Performance (2019–2024)

-

Market Outlook (2025–2033)

-

COVID-19 Impact on the Market

-

Porter’s Five Forces Analysis

-

Strategic Recommendations

-

Historical, Current and Future Market Trends

-

Market Drivers and Success Factors

-

SWOT Analysis

-

Structure of the Market

-

Value Chain Analysis

-

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=31741&flag=E

🔍 FAQs: Australia Meat Market

Q1: What was the size of the Australia meat market in 2024?

A: The market size reached USD 28.6 Billion in 2024.

Q2: What is the expected CAGR of the Australia meat market during 2025–2033?

A: The market is expected to grow at a CAGR of 1.93% during this period.

Q3: What are the key trends shaping the Australia meat market?

A: Key trends include rising demand for premium and grass-fed meats, growth in plant-based and hybrid alternatives, and increased focus on traceability and export readiness.

Q4: Who are the major players in the Australia meat market?

A: Major players include JBS Australia, Teys Australia, Australian Agricultural Company, NH Foods Australia, Thomas Foods International, and Fletcher International Exports.

Q5: What are the main segments covered in the Australia meat market report?

A: The report covers type (raw, processed), product (chicken, beef, pork, mutton, others), distribution channel, and regional segmentation.

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Know more about: https://fastpanda.in/