Banking Encryption Software Market 2024-2032:

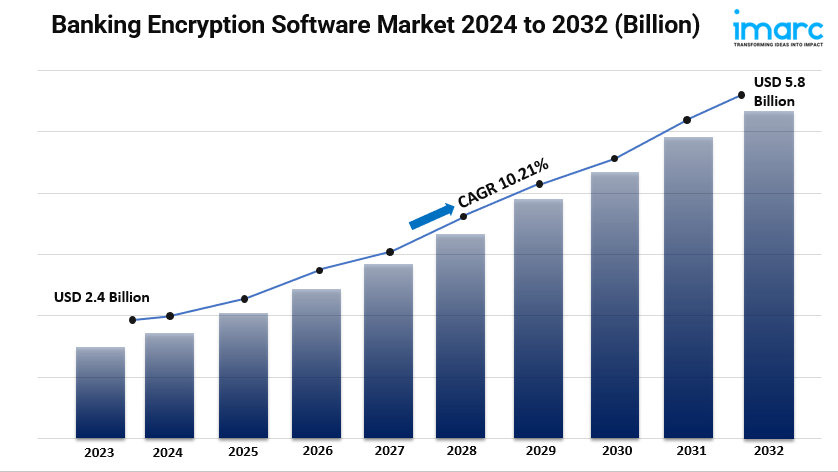

- The global banking encryption software market reached USD 2.4 Billion in 2023.

- The banking encryption software market size is expected to reach USD 5.8 Billion by 2032, exhibiting a growth rate (CAGR) of 10.21% during 2024-2032.

- North America leads the market, accounting for the largest banking encryption software market share.

- Software accounts for the majority of the market share in the product type segment because of its vital role in putting encryption protocols into place and safeguarding private financial information in banking systems.

- On-premises holds the largest share in the banking encryption software industry.

- Large enterprises remain a dominant segment in the market due to the fact that they frequently handle enormous volumes of sensitive data and are more likely to spend money on complete encryption solutions to safeguard their business.

- Disk encryption represents the leading function segment.

- The increasing awareness of data privacy among consumers as customers expect financial institutions to protect their personal and financial information from unauthorized access is bolstering the market growth.

- Additionally, the expansion of the Internet of Things (IoT) in banking services as more connected devices generate sensitive data that requires secure transmission and storage to mitigate potential security risks thereby impelling the market demand.

Industry Trends and Drivers:

- The increasing frequency of cyberattacks:

Financial institutions are prime targets for cybercriminals due to the sensitive nature of the data they handle, including personal information, financial records, and transaction details. High-profile breaches and ransomware attacks have highlighted vulnerabilities in banking systems, prompting institutions to invest heavily in cybersecurity measures to protect against data theft and unauthorized access. Encryption software is crucial in safeguarding sensitive information by converting it into an unreadable format that can only be accessed by authorized users with the proper decryption keys. As cyber threats become more sophisticated, banks recognize the necessity of implementing robust encryption solutions to defend against potential breaches and to ensure the integrity and confidentiality of customer data, bolstering the banking encryption software market demand.

- Regulatory compliance requirements:

Regulatory compliance requirements also play a vital role in driving the banking encryption software market. Financial institutions are subject to stringent regulations aimed at protecting consumer data and ensuring the security of financial transactions. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the Payment Card Industry Data Security Standard (PCI DSS) globally require banks to implement comprehensive data protection measures, including encryption of sensitive information. Non-compliance can result in hefty fines and legal repercussions, making encryption a critical component of any bank’s compliance strategy. As regulatory frameworks continue to evolve and expand, banks are increasingly motivated to adopt encryption solutions that meet these requirements and enhance their overall cybersecurity posture is aiding the market growth.

- Growing adoption of digital banking services:

The growing adoption of digital banking services is another key factor driving the demand for banking encryption software. As more consumers shift to online and mobile banking platforms for convenience and accessibility, the volume of sensitive transactions conducted over digital channels has surged. This trend necessitates the implementation of robust encryption technologies to protect customer information during transmission and storage. Banks are leveraging encryption to secure online transactions, mobile applications, and cloud-based services, ensuring that customer data remains confidential and protected from potential threats. Besides this, the rise of fintech companies and digital payment solutions to maintain trust and security in the increasingly competitive banking landscape thus contributing to the market demand.

Request for a sample copy of this report: https://www.imarcgroup.com/banking-encryption-software-market/requestsample

Banking Encryption Software Market Report Segmentation:

Breakup By Component:

- Software

- Services

Software accounts for the majority of share due to its critical role in implementing encryption protocols and protecting sensitive financial data within banking systems.

Breakup By Deployment:

- On Premises

- Cloud based

On-premises dominates the market as many banks prefer to maintain control over their security infrastructure and sensitive data within their own facilities to mitigate risks associated with cloud storage.

Breakup By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises hold the majority of shares because they typically manage vast amounts of sensitive data and are more likely to invest in comprehensive encryption solutions to protect their operations.

Breakup By Function:

- Disk Encryption

- Communication Encryption

- File/Folder Encryption

- Cloud Encryption

Disk encryption represents the majority of shares as it safeguards stored data on servers and devices, ensuring that sensitive information remains protected even in the event of physical theft or unauthorized access.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America holds the leading position due to the presence of major financial institutions, advanced cybersecurity regulations, and significant investments in encryption technologies to enhance data protection.

Top Banking Encryption Software Market Leaders:

The banking encryption software market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Broadcom Inc.

- ESET spol. s ro

- International Business Machines Corporation

- McAfee

- LLC

- Sophos Ltd.

- Thales Group

- Trend Micro Inc.

- WinMagic

Ask Analyst Browse full report with TOC List of Figures: https://www.imarcgroup.com/request?type=reportid=7464flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most changemakers to create a lasting ambitious impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145