Carpet Market – United States

Market Statistics

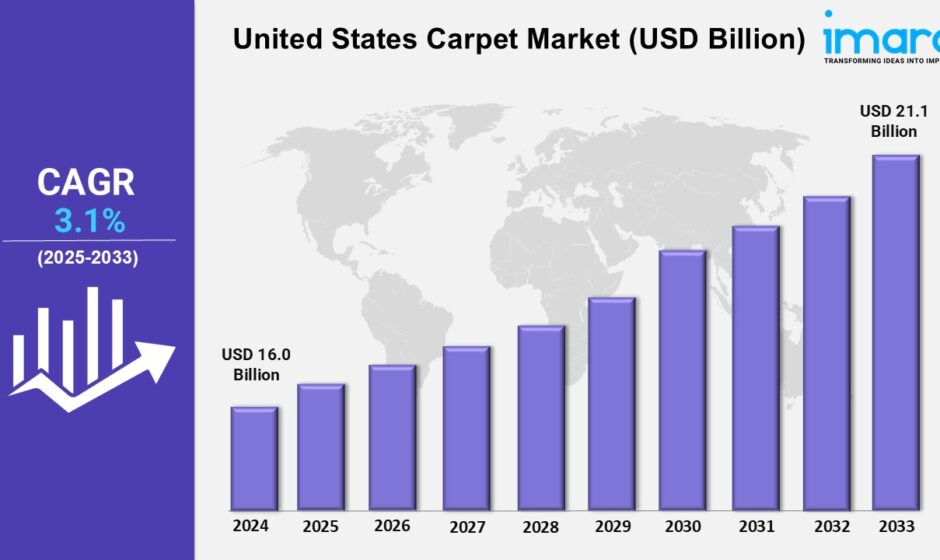

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 16.0 Billion

Market Size in 2033: USD 21.1 Billion

Market Growth Rate (CAGR) 2025-2033: 3.1%

According to IMARC Group’s report titled “United States Carpet Market Report and Forecast 2025-2033,” the market reached USD 16.0 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.1 billion by 2033, exhibiting a growth rate (CAGR) of 3.1% during 2025-2033.

Download sample copy of the Report: https://www.imarcgroup.com/united-states-carpet-market/requestsample

United States Carpet Market Trends and Drivers:

-

The United States carpet market is confronting gigantic growth driven by the synergy of changing consumers’ lifestyles, technological innovations, and robust economic trends revolutionizing the art of construction and interior designing.

-

Growing disposable incomes and enhanced focus on looks within households have been encouraging consumers to spend on premium, durable, and style-focused carpeting products that are enhancing comfort as well as beauty within homes and businesses.

-

Rising urbanization and renovation activity have propelled demand for latest, eco-friendlier carpets that address the prevailing trend and enhance functionality.

-

Manufacturing innovation through methods such as digital printing, high-finish textile designing, and automations helped manufacturers deliver highly customized designs, improved stain repellence, and greater longevity at competitive prices.

-

Rising environmental awareness is also pushing customers and firms toward using recycled materials and natural fibers carpets that support green manufacturing and reduce overall carbon footprints.

-

E-commerce and web network growth has re-arranged channels of distribution in such a way that consumers can research, compare, and purchase carpet products more correctly and conveniently, enhancing market penetration and loyalty.

-

Joint business ventures among carpet manufacturers and interior design firms are also coming up with new ideas and product matching according to upcoming trends in construction and decoration.

-

The acceptance of advanced logistics and supply chain management systems has increased delivery efficiency and goods availability, and also promoting customer satisfaction.

-

Policy measures for domestic production and quality standards have provided a safe ground for investment, and hence the competition has increased.

-

Virtual showrooms and augmented reality computer programs are improving the process of retailing since they enable buyers to visualize carpet designs in their surroundings.

-

Combined, the intersection of growing consumer spending, advanced technology, environmentalism, and supportive regulatory environments is working toward long-term, sustained growth throughout the United States carpet market business to create a strong, healthy, and competitive market within the overall home furnishings sector.

United States Carpet Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest United States carpet market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Material Insights:

- Nylon

- Olefin

- Polyester

- Others

Price Point Insights:

- Economy

- Luxury

Sales Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

End User Insights:

- Residential

- Commercial

Regional Insights:

- Northeast

- Midwest

- South

- West

Request for customization: https://www.imarcgroup.com/request?type=report&id=10194&flag=C

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Table Of Content:

1 Preface

2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 United States Carpet Market – Introduction

4.1 Overview

4.2 Market Dynamics

4.3 Industry Trends

4.4 Competitive Intelligence

5 United States Carpet Market Landscape

5.1 Historical and Current Market Trends (2019-2024)

5.2 Market Forecast (2025-2033)

6 United States Carpet Market – Breakup by Material

6.1 Nylon

6.1.1 Overview

6.1.2 Historical and Current Market Trends (2019-2024)

6.1.3 Market Forecast (2025-2033)

6.2 Olefin

6.2.1 Overview

6.2.2 Historical and Current Market Trends (2019-2024)

6.2.3 Market Forecast (2025-2033)

6.3 Polyester

6.3.1 Overview

6.3.2 Historical and Current Market Trends (2019-2024)

6.3.3 Market Forecast (2025-2033)

6.4 Others

6.4.1 Historical and Current Market Trends (2019-2024)

6.4.2 Market Forecast (2025-2033)

7 United States Carpet Market – Breakup by Price Point

7.1 Economy

7.1.1 Overview

7.1.2 Historical and Current Market Trends (2019-2024)

7.1.3 Market Forecast (2025-2033)

7.2 Luxury

7.2.1 Overview

7.2.2 Historical and Current Market Trends (2019-2024)

7.2.3 Market Forecast (2025-2033)

8 United States Carpet Market – Breakup by Sales Channel

8.1 Supermarkets and Hypermarkets

8.1.1 Overview

8.1.2 Historical and Current Market Trends (2019-2024)

8.1.3 Market Forecast (2025-2033)

8.2 Specialty Stores

8.2.1 Overview

8.2.2 Historical and Current Market Trends (2019-2024)

8.2.3 Market Forecast (2025-2033)

8.3 Online Stores

8.3.1 Overview

8.3.2 Historical and Current Market Trends (2019-2024)

8.3.3 Market Forecast (2025-2033)

9 United States Carpet Market – Breakup by End User

9.1 Residential

9.1.1 Overview

9.1.2 Historical and Current Market Trends (2019-2024)

9.1.3 Market Forecast (2025-2033)

9.2 Commercial

9.2.1 Overview

9.2.2 Historical and Current Market Trends (2019-2024)

9.2.3 Market Forecast (2025-2033)

10 United States Carpet Market – Breakup by Region

10.1 Northeast

10.1.1 Overview

10.1.2 Historical and Current Market Trends (2019-2024)

10.1.3 Market Breakup by Material

10.1.4 Market Breakup by Price Point

10.1.5 Market Breakup by Sales Channel

10.1.6 Market Breakup by End User

10.1.7 Key Players

10.1.8 Market Forecast (2025-2033)

10.2 Midwest

10.2.1 Overview

10.2.2 Historical and Current Market Trends (2019-2024)

10.2.3 Market Breakup by Material

10.2.4 Market Breakup by Price Point

10.2.5 Market Breakup by Sales Channel

10.2.6 Market Breakup by End User

10.2.7 Key Players

10.2.8 Market Forecast (2025-2033)

10.3 South

10.3.1 Overview

10.3.2 Historical and Current Market Trends (2019-2024)

10.3.3 Market Breakup by Material

10.3.4 Market Breakup by Price Point

10.3.5 Market Breakup by Sales Channel

10.3.6 Market Breakup by End User

10.3.7 Key Players

10.3.8 Market Forecast (2025-2033)

10.4 West

10.4.1 Overview

10.4.2 Historical and Current Market Trends (2019-2024)

10.4.3 Market Breakup by Material

10.4.4 Market Breakup by Price Point

10.4.5 Market Breakup by Sales Channel

10.4.6 Market Breakup by End User

10.4.7 Key Players

10.4.8 Market Forecast (2025-2033)

11 United States Carpet Market – Competitive Landscape

11.1 Overview

11.2 Market Structure

11.3 Market Player Positioning

11.4 Top Winning Strategies

11.5 Competitive Dashboard

11.6 Company Evaluation Quadrant

12 Profiles of Key Players

12.1 Company A

12.1.1 Business Overview

12.1.2 Services Offered

12.1.3 Business Strategies

12.1.4 SWOT Analysis

12.1.5 Major News and Events

12.2 Company B

12.2.1 Business Overview

12.2.2 Services Offered

12.2.3 Business Strategies

12.2.4 SWOT Analysis

12.2.5 Major News and Events

12.3 Company C

12.3.1 Business Overview

12.3.2 Services Offered

12.3.3 Business Strategies

12.3.4 SWOT Analysis

12.3.5 Major News and Events

12.4 Company D

12.4.1 Business Overview

12.4.2 Services Offered

12.4.3 Business Strategies

12.4.4 SWOT Analysis

12.4.5 Major News and Events

12.5 Company E

12.5.1 Business Overview

12.5.2 Services Offered

12.5.3 Business Strategies

12.5.4 SWOT Analysis

12.5.5 Major News and Events

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Read Also: https://fastpanda.in/2021/10/30/main-slot-mahjong-ways-situs-website-terbaik-gampang-maxwin-2024/

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145